By Kumar David –

There is a school of thought (my sparing partners I call them) which contends that the mighty dollar is on its way out as the global trade and reserve currency. Though the argument is flawed it is not without merit. The IMF estimates that China’s economy grew by about 1.9% in pandemic ravaged year 2020 while it declined by 4.3% in the US in the same year. Forecasters now expect the Chinese economy to expand by a stellar 8% in 2021 and the US at a modest 2%; star gazing beyond 2021 is silly till the shape of the post-corvid universe is clearer. Depending on which ‘erudite’ bunch of dismal scientists you consult the Chinese economy will overtake the American in size somewhere between 2028 and 2032 on a nominal currency basis – it is already bigger on a PPP basis. These numbers are impressive and relevant for a different discussion, viz. choice of a development model (free-market capitalism supported by liberal democracy versus a government-led mixed economy under the guardianship of a strong centralised state) for the developing world if not others as well. But I argue that these striking statistics do not sufficiently support my challengers’ case for the likelihood of the Yuan emerging as an alternative to the dollar as the world’s global currency.

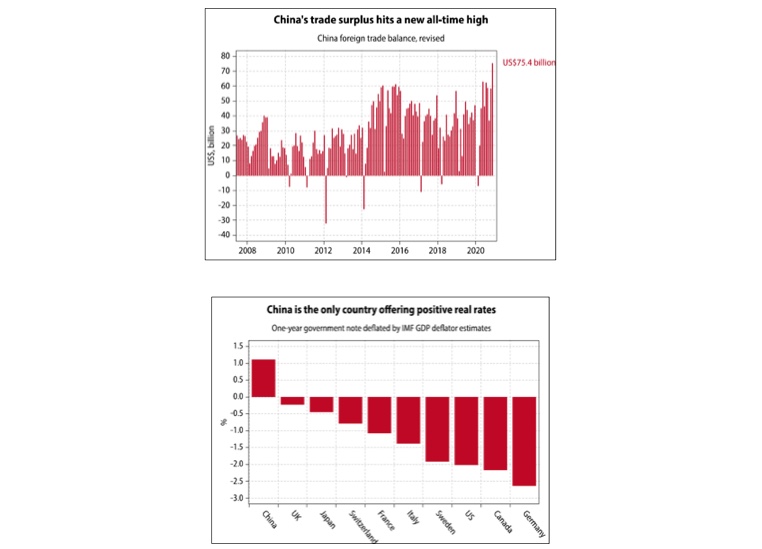

My sparing partners then respond with two other economic trends that are more relevant to the dispute – foreign trade balances and interest rates. China’s trade surplus has averaged about $40 to $50 billion a month since 2015 and in post-covid November 2020 shot up to $75 billion. The high positive trade balance scenario is likely to persist throughout 2021 and 2022 as the rest of the world recovers and imports capital good from China to underpin recovery. Or, other economists argue, it may be a short-lived spike since others will enhance their output and need less from China. (It was Harry Truman who lamented “Oh for a one-handed economist. All my economists say ‘on one hand…’, then ‘but on the other…”). Admittedly the currency of a country with a large trade balance and foreign currency reserves ($1 trillion in China’ case) is a candidate for global status.

The second point that proponents of the Yuan-thesis advance is that China is the only country offering positive interest rates on one-year government bonds after the conventional deflators to deduct the effect of inflation on yields are taken into account. They, my detractors, back it up with remarks like “The whole US$ house of cards will tumble when inflation flares up in the US – already happening but hidden by using bogus inflation measures such as PCE inflation, which measures the inflation experienced by the rich 1%. Before long even PCE inflation will exceed 2%”. (The Personal Consumption Expenditure in gross domestic product consists of expenditure of households on durable and non-durable goods and services). I do not agree that PCE is a bogus inflation deflator, but I do concede that an increase in the US inflation rate above the prevailing 1.2% to 1.5% range is very likely. Advocates of MMT that is Modern Monetary Theory (the debt obsessed guys who want to run the electronic money printing press all day and all night) are deluded that inflation is a bogey of a bygone era. I am not a convert to MMT but let that pass; I have discussed it in previous columns.

There are five fundamental reasons why the Yuan cock won’t fight nor win the battle to become the global payments and reserve currency option in the foreseeable future. They are:-

* There is nowhere near enough Yuan in circulation to lubricate all global investment and trade. Or to put it in other words; Chinese financial pockets are nowhere near deep enough to meet global needs.

* The Yuan is not freely convertible, either due to restrictions or because some jurisdictions are not in a position to process Yun transactions with adequate flexibility.

* Chinese financial markets and banks still constitute a relatively ‘closed economy’.

* The dollar’s successor will be a bastard mix of the Dollar, Gold, Euro, Yuan and SDRs – (Yen?).

There is about $2 trillion worth of US dollar bills in circulation. It is the most popular currency in use worldwide — central-bank reserves, wealthy people’s cash holdings, and money laundering. Grounded on the historical reach and power of US Imperialism since WW2 and because of America’s political stability (Trump’s attempted coup gave everyone a fright though) it is the most liquid currency as a global store of value and safety net. There is about $5 trillion worth, in all currencies, in circulation throughout the world, most of it domestic except the $, Euro, Pound and Yen. The five trillion is what is called the narrow money supply, which is notes and coins. But using a more inclusive definition of money called broad money the amount is much higher since it adds the money in bank current and savings accounts and money-market accounts. This is all money that can be quickly digitally accessed and used. Estimates of the quantum of global broad money vary; the IMF puts it at $35 trillion and the CIA $80 trillion. Take one more step pertinent to my argument and include global hedge funds and derivatives, investments and market capitalisations, then global financial value is estimated at between $500 trillion and $1000 trillion. I cannot be sure, but say a third or more is capitalised in US$.

The narrow money supply in China is equivalent to $1.2 trillion in US dollar terms and therefore comparable to the US, while broad money supply is estimated as equivalent to $33 trillion, again comparable to US dollar money supplies. But nearly all of China’s money supplies are held within China and Hong Kong. However, it is when it comes to the value of global investments, funds and market capitalisations that a big difference shows up. Ali’s Ant Groups whose recent IPO was thwarted (or deferred) by the authorities is valued at $200 billion, while the market capitalisation of China’s largest banks including Hong Kong’s banks is equivalent to about $2 trillion. It is impossible for me with zero research support to make a proper estimate of the capitalisation of China’s companies and giant corporations (many state owned) and China’s overseas holdings. But I would be amazed if it all tots up to more than $50 trillion, which is only a tenth to twentieth of global financial values. This is what makes the Chinese Yuan far from ready to sally forth as an alternative global currency.

China has a few useful cards up its sleeve that could tilt the balance to a degree if it decided to play hardball. A shift from the $ to Yuan could happen in the oil market if China, as the world’s largest importer, attempted to create a Yuan-denominated crude-oil market. Or if it demand payment in Yuan for its exports, which will handicap the US which doesn’t earn sufficient Yuan through exports to China to pay for imports from China. At this stage in the discussion I think it necessary to interject that China does not want to launch the Yuan as a global currency and as major alternative reserve and payments mechanism. Anyone who is witness to the currency chaos that the US may soon run into would be wary. The reserve currency status of the $ has let America pay for everything by merely printing money. This can go on for only so long as people are willing to accept it for purchases or to hold it as a reserve. Has China been playing a long game to dethrone the $, as one of my discussants suggests? I am not sure, but for sure US sanctions on Chinese and Hong Kong leaders and attempts to undermine Chinese technology companies (Huawei most clearly) must be pushing Beijing nearer the edge. There is evidence that China has been accumulating gold and furthermore the Chinese 10-year bond yield now is relatively high at 3% – meaning the Yuan is payments-secure.

A reserve currency should be a medium of exchange, a unit of account and also a store of value. The $ passes with flying colours on the first two counts but with a real interest rate of -2% it is failing as a store of value compared to the Yuan which offers investors a real interest rate of +1%. But the depreciation of the dollar against major currencies is a slow and uneven process. On balance and taking into account the arguments I have advanced in this column, clearly the Yuan’s day has still not dawned. And there is a sting in the tail for Sri Lanka; the gods atop mount Yuan are not in a place from which to vaporise our foreign debt chaos by magic.

Sinhala_Man / December 27, 2020

Dear Professor Kumar,

.

Although right now for us in Sri Lanka, the little giant that had conquered the COVID by the time of August 2020 Elections, the pandemic has once more become the major worry, how the Sri Lankan Rupee is faring becomes another worry.

.

What you have rightly compared here are the currencies of the two major economies, because a tiny disorganised economy like ours is at the mercy of the giants. I’ve probably been naive, but my first concern being buying myself some food, I’ve tried to see how our rupee is facing against about ten currencies during the past month. It looks as though there has been a steady, but not startling, decline of our Rupee up to the 23rd of December. A slight improvement up to Christmas Day.

.

Now let me see what other comments get attracted by this seemingly very recent article.

/

westham / December 27, 2020

The world has moved away from the dollar to cryptocurrency or blockchain technology. With China leading the way. They are well on the way to winning the currency war. The Chinese central bank backed digital yuan is going to take over in next 20 years. Prof David and wijewardene of the central bank both of whom write on economic issues never mention digital currency because they don’t understand it. David should talk to his grandchildren about before making a fool of himself.

/

SJ / December 28, 2020

This comment in Forbes.com on 15.10.20 is interesting:

“One day the dollar’s hegemony will be ended, either by the digital yuan, bitcoin, libra, another form of money, or some combination of the above. It is important to recognize these patterns so investors can anticipate where money will flow during times of strife.

The most likely outcome is that when the dollar falls the financial system becomes a multipolar world, suggesting that investors will require additional diversification in its ‘safe haven’ portfolio. The yuan may certainly deserve a place in this portfolio, especially as the Chinese economy continues to recover, its bond market offers higher yields than other places around the world, and the yuan continues to appreciate.”

*

It is premature to declare the demise of the US$, and even more so to suggest its replacement by the Renminbi.

/

chiv / December 27, 2020

Prof, US did not become a superpower overnight and maintained its status for more than a century. There is nothing wrong in dreaming but it will stay same until it turns real. Remember diversity, democracy , equal opportunity are cog wheels to get there. Without it you are just a regional bully.

/

SJ / December 27, 2020

Wonder what it took it to become a global bully!

/

SJ / December 28, 2020

No answer yet!

/

SJ / December 27, 2020

Your “sparing partners”?

*

Does China have such a goal in mind? Why should it be the Yuan?

The grip of the US$ on global trade is certainly slackening; with a switch towards dollar-free transactions of various kinds among several countries.

Nothing will happen overnight though.

*

They were confident about the security of the Gold Standard less than half a century ago.

/

chiv / December 28, 2020

The yuan has been so powerful that Chinese had to manipulate for this many years. Trump has been sanctioning company after company and denied visas , yet Chinese have only managed to make empty threats/ retaliations.. They keep saying we will take action at the right time does it mean some Chinese astrological significance. After so much of theatrics they still are allowing US agricultural products in larger numbers as per the new agreement. Huawei has been completly dismantled by US and many others to follow for security reason.

China tried bullying China and Australia by sanctioning wine and other products didnt work. Now Chinese officials, students and contract workers are asked to leave for their anti national and hacking activities. Who is bullying who Mr. know it all.

/

chiv / December 28, 2020

SORRY China tried bullying Canada and Australia by threatening to sanction wine and cut down natural resources ( by heavy taxing)

/

Pon Lanka / December 28, 2020

Prof. Kumar David Chinese Yuan would never become a world super currency and cannot be comparable with the US Dollar at any time. U.S dollar has a huge base in Europe alone known as Euro dollar that is about 40 % of the total U.S. dollar, on which even U.S has lost its control. Moreover, many of the other world largest 20 powerful economies such as Germany, U,K, France,Russia, Japan, Canada ,Australia,South Korea,India, Brazil,Argentina ,Saudi Arabia etc and even Chin are depending upon

the U.S dollar parity for their international trading. Chinese Yuan became popular in the world trade because of its monetary value being kept below par in terms of the U.S.dollar. As a result Chinese goods are being sold cheaper and flooded into other countries . Further, Other major exporting countries of similar products are unable to compete with china . However,President Donald Trump was able to reduce this inflow of Chinese goods by levying tariffs on Chinese imports to U.S.

/

SJ / December 28, 2020

Hitting at China will not cure the ills of the US economy.

So, do not bother about the Renminbi; it is the plight of the dollar that is the issue.

/

SJ / December 29, 2020

“Dollar is our currency, but your problem”

as told by President Nixon’s Treasury Secretary, John Connally at the G-10 Rome meetings in 1971 to a group of European finance ministers worried about the export of American inflation.

How true even today, nearly 50 years on.

*

Note:

On August 15, 1971, President Nixon directed Treasury Secretary Connally to suspend, with certain exceptions, the convertibility of the dollar into gold or other reserve assets, ordering the gold window to be closed such that foreign governments could no longer exchange their dollars for gold.

/

chiv / December 29, 2020

Dollar was there before you were born and it will still be there after you . So Mr. Know it all , you better bother about your toilet paper called Lankan Rupee and leave the Dollar to real economist. Hope you got your answer.

/

SJ / December 29, 2020

Oh dear!

Still struggling for an answer to “Wonder what it took it [the US] to become a global bully!”

Try this:

“malle pol”

It sure is a better answer than any you can offer.

/

Thiagarajah Venugopal / December 29, 2020

Dear Prof

I would rather ask as a common man the same question why one would ever dare Replace a Dollar?

Only if one want to have the same fate as the Hon Col Gaddafi is one answer??

/

SJ / December 29, 2020

TV

What has the cruel end of a vastly popular Gaddafi to do with the subject?

His error was to make concessions to the West, which was seen as weakness.

Nothing is for ever and so is the supremacy of the US$.

The struggling US economy will sooner or later destroy its credibility.

(BTW, do you have some dollars in savings to worry about? The US$ will last a while as an international currency.)

/

michael fernando / December 29, 2020

Replacing one currency as s global exchange medium with another currency is not only an economic activity but also has a political aspect. USA would definitely prefer to maintain the supremacy of Dollar as a global exchange medium !

/

chiv / December 30, 2020

Pon you are right. There is international basket of currencies for trading ‘, decided by pegging, there is SDR used by IMF , there is currency markets for trading , in all of these Yuan is included ( as early as in 2016) others being US, Euro, Sweden , Switzerland, Yen’Canada’,Australia and few others. But Chinese artificially manipulated theirs for trade advantage and lost credibility. Will anyone trade a currency knowing it is manipulated by own government. Mr. Know it all , Cheats use bullying as excuse. It is like Russians who cheat in sporting world when caught , play victim ,claiming they were bullied. By the way did you get the new year greetings from China. Apparently Rajapaksas.foreign ministry and few other ball carriers got hand written thank you notes. And renminbi Ayuduru.

/

chiv / December 30, 2020

Mr. Know it all, my purpose here is not to enlighten you. As usual the discussion is on international currencies for trading and Yuan was accepted in SDR in 2016 .You as usual quote what Nixon said before many of us here were born. It is a well known fact about US applying pressure, which Russia, China, UK and even lesser countries have been accused of. You are one of those intelligent Lankan who loves harping on who killed more.who is less corrupt and based on it pick your leaders..

/

SJ / December 30, 2020

Seriously

Try “malle pol”.

Works brilliantly when you are at a loss to make a sensible utterance.

/

chiv / December 31, 2020

SJ have you noticed you blabber about Nixon and then advise TV about Gadaffi. I do not know much about mallepol but can differentiate from Narcissism.

/