By Hema Senanayake –

Hema Senanayake

Higher rates of interest cost billions, perhaps trillions of rupees for people, businesses, and the government. The Monetary Board at its meeting held on January 23rd, 2023, decided to keep the policy interests unchanged at current higher level. This is what tight monetary policy is. The reason was to curtail the inflation. Many economists are not convinced with the approach and the hopes were dashed for employees of all kinds, entrepreneurs, especially small and medium scale entrepreneurs, self-employed people like three wheelers etc. whose old loans or equipment leases adjusted to new higher rates by banking institutions. They wanted interest rates to come down. It should come down before the economy and their lives are destroyed.

Previously, people did not care about the meetings of the Monetary Board or the policy decisions they make. They thought that those were some abstract decisions only bankers and investors should be interested upon. Things are different now. People are eagerly waiting to hear decisions made by the Monetary Board and the Central Bank, because people know that such decisions seriously affect to their day-to-day life.

This time around, at least a few economists did not agree with the Central Bank’s decision to have continuing tight monetary policy, because data they have is different or the way they look at data is different. Usually, demand driven inflation that should be curtailed by increasing interest rates occurs when there is excessive private sector (businesses and households) credit growth. Does the Central Bank observe any such credit growth? In this regard we do not have data, but theoretically we know that there cannot be excessive credit growth. When the currency crashes, relative value of salaries & wages shrunk by nearly 50% due to depreciation of rupee, interbank borrowing freezes, credit issuance became insignificant, there cannot be excessive private credit growth. Does the Central Bank observe higher private credit growth? The Central Bank needs to provide us with data. Recently, I asked this question from a CEO of a prominent think tank. He didn’t have exact data but said that if private credit growth is not negative then it cannot be significant. If this is the case, there cannot be demand driven persistent inflation that should be curtailed by continuing tight monetary policy. You might not be convinced, because there is still an inflation of around 58% or so according to the government. This is where the way we look at the same data of census department that calculate inflation statistics, differs from the Monetary Board. Let me explain further.

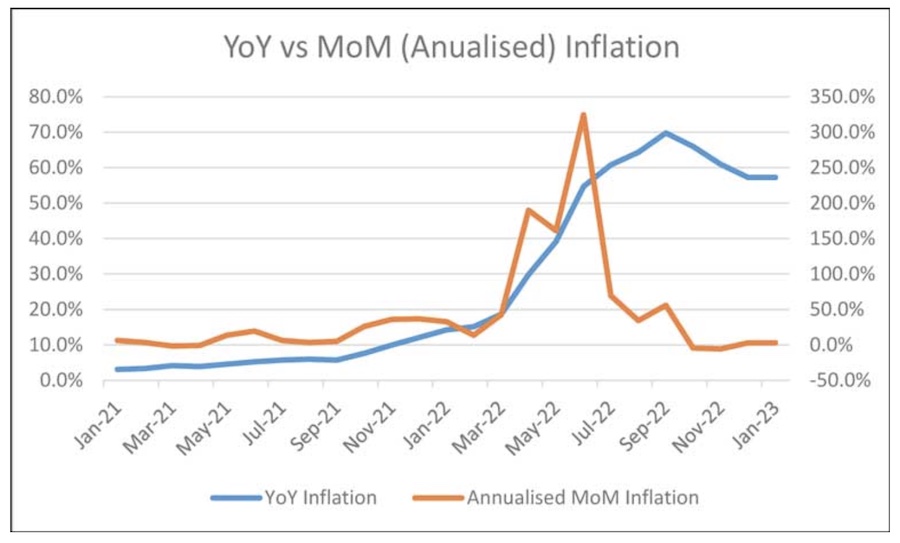

The peak inflation we had in September last year was not demand driven one. It was resulted from the rapid devaluation of rupee and subsequent cost-push inflation. If the inflation is demand driven, as pointed out above, it should be linked to the high private credit growth. This clearly intimates that there cannot be a demand driven inflation right now that should be curtailed by tight monetary policy or having higher policy rates by the Central Bank. Does this mean that inflation is not a concern anymore? It should be a concern but not the way the country’s monetary and fiscal policy authorities understand it. Regarding this point, Chatura Wickrematilleka writing a guest column to DailyFT made a good revelation. He pointed out that if we look at the Year on Year (YoY) inflation still we have an inflation (YoY) of around 58% down from the peak rate of inflation (YoY) 69.8% we had in September last year. However, if we consider the annualized Month on Month (MoM) inflation, in recent months there is no excessive inflation as the annualized MoM inflation has come down to around 10%. You may see this trend from the following chart. (This chart has been produced by Chatura Wickremetilleka, published in DailyFT on January 25th, 2023)

I invite the Central Bank to look at this convincing data. Some people do make mistakes in setting medium to long term goals based on unprecedented economic circumstances facing very short term. Is the Central Bank doing the same mistake?

I invite the Central Bank to look at this convincing data. Some people do make mistakes in setting medium to long term goals based on unprecedented economic circumstances facing very short term. Is the Central Bank doing the same mistake?

However, responsible citizens should not push the Central Bank to do more mistakes as it had done enough in recent past being part of bringing this crisis. But we must question the Bank. Can the Central Bank bring down the interest rates? We know that if interest rates have come down, possibly there could be increased demand for money. Usually when there is excessive private credit growth, it could negatively affect to the country’s current account, destabilizing the rupee again. Therefore, the Central Bank has a few options. While reducing interest rates, the Central Bank can use macroprudential and micro-prudential tools to contain credit growth. Best known, macroprudential tool is the Loan-to-Value ratio. Adjusting this ratio, the demand for money can be contained without increasing interest rates.

However, the bottom line is that the Central Bank should not make any policy decisions that could destabilize the rupee again. Having more stable exchange rate is important. This does not mean that the Central Bank should not bring down the interest rates while containing the credit growth to tolerable level, using other administrative and macroprudential tools. If we do that then we will have fairly low (annualized MoM) rate of inflation on continued basis while having interest rates reduced. Isn’t this what the Central Bank should do?